Fusion Startups Step in to Realize Decades-old Clean Power Dream

THE WALL STREET JOURNAL

DANIEL MICHAELS

February 6, 2020

Governments have spent billions of dollars studying the emissions-free energy source. Now, private ventures are building smaller, faster, cheaper reactors.

If Nick Hawker’s computer models are right, the snap of a pistol shrimp’s claw holds the secret to boundless clean energy.

Mr. Hawker’s company, First Light Fusion, is one of around two dozen startups chasing the dream of generating electricity by squeezing atoms together.

Fusion, first theorized a century ago and shown to be possible decades later, is the same power that lights the sun and every other star, as well as hydrogen bombs. All it requires is the force to press small atoms together to build bigger ones—a process that releases huge amounts of energy, no greenhouse emissions and limited radioactivity.

The hitch is that these atoms repel each other, and overcoming that resistance requires enormous strength. In stars, gravity does the job, but on Earth we must find other methods. Scientists now are building systems that squeeze, pummel and bombard atoms into submission. Their challenge is to get far more energy out of a reaction than they put in, a feat nobody has yet accomplished.

Oxford, England-based First Light Fusion co-founders Yiannis Ventikos, left, and Nick Hawker stand atop a machine they’ve developed that can discharge up to 200,000 volts and more than 14 million amperes of power within two microseconds. Source: JEREMIE SOUTEYRAT FOR THE WALL STREET JOURNAL

Concerns about global warming have brought fresh intensity to a field that languished for years. In December, Congress boosted research spending on fusion, recognizing it as a promising clean energy source to reliably power big economies.

“If we can make fusion work, it really would be the perfect way to generate energy,” says Steven Cowley, director of the Princeton Plasma Physics Laboratory, a pioneer in the field run by Princeton University for the Energy Department.

Princeton and many other advanced labs are trying to fuse hydrogen isotopes by enveloping them in an intense magnetic field that traps and squeezes the atoms, heating them to temperatures 10 times the sun’s core. Physicists generate the field with electromagnets demanding so much current that they must be superconductive, which has required cooling to near absolute zero—the point where all motion stops.

For years, scientists believed that this required reactors big enough to walk through, powered by electromagnets heavier than a blue whale and house-sized freezers. Budgets ran in billions of dollars, meaning only governments could underwrite fusion experiments.

Technological breakthroughs have upended those assumptions. Advances in computing, precision machinery and synthetic materials have allowed scientists to design reactors a fraction of the size and cost of those just a few years ago. Lower price tags have put fusion within reach of private investors, allowing ventures to sprout.

Advances in computer modeling brought First Light’s Mr. Hawker to fusion over a decade ago, when he was getting a Ph.D. on simulating fluid dynamics at the University of Oxford. Mr. Hawker’s adviser, Yiannis Ventikos, was intrigued by bubbles collapsing under intense force, like those produced by the tiny pistol shrimp’s claw, which it snaps to generate a “bubble bullet” that stuns its prey. Scientists in 2001 had shown that the implosions produced not just noise but also extreme pressure, a flash of light—dubbed shrimpoluminescense—and temperatures exceeding 5,000 degrees Kelvin.

Physicists decades earlier had considered bubble collapse to trigger fusion but lacked the computing power or math to model it, so looked elsewhere. Revisiting the question with advanced algorithms and powerful processors, Mr. Hawker and Mr. Ventikos showed the potential to generate million-degree conditions needed for fusion.

Today, First Light has raised £25 million (US$32.8 million) to build machines for testing its computer models. If the shock waves deliver, the next step is to build a prototype generator, potentially as soon as 2025.

“Things that were unthinkable 10 or 20 years ago are now fairly straightforward,” says Jonathan Carling, chief executive of Tokamak Energy, another startup based near Oxford, England, a fusion hub.

Tokamak Energy, which recently raised £67 million (US$ 87.3 million), and at least two North American startups also aim around 2025 to fire up prototype fusion reactors, each roughly the size of turbines inside traditional power plants.

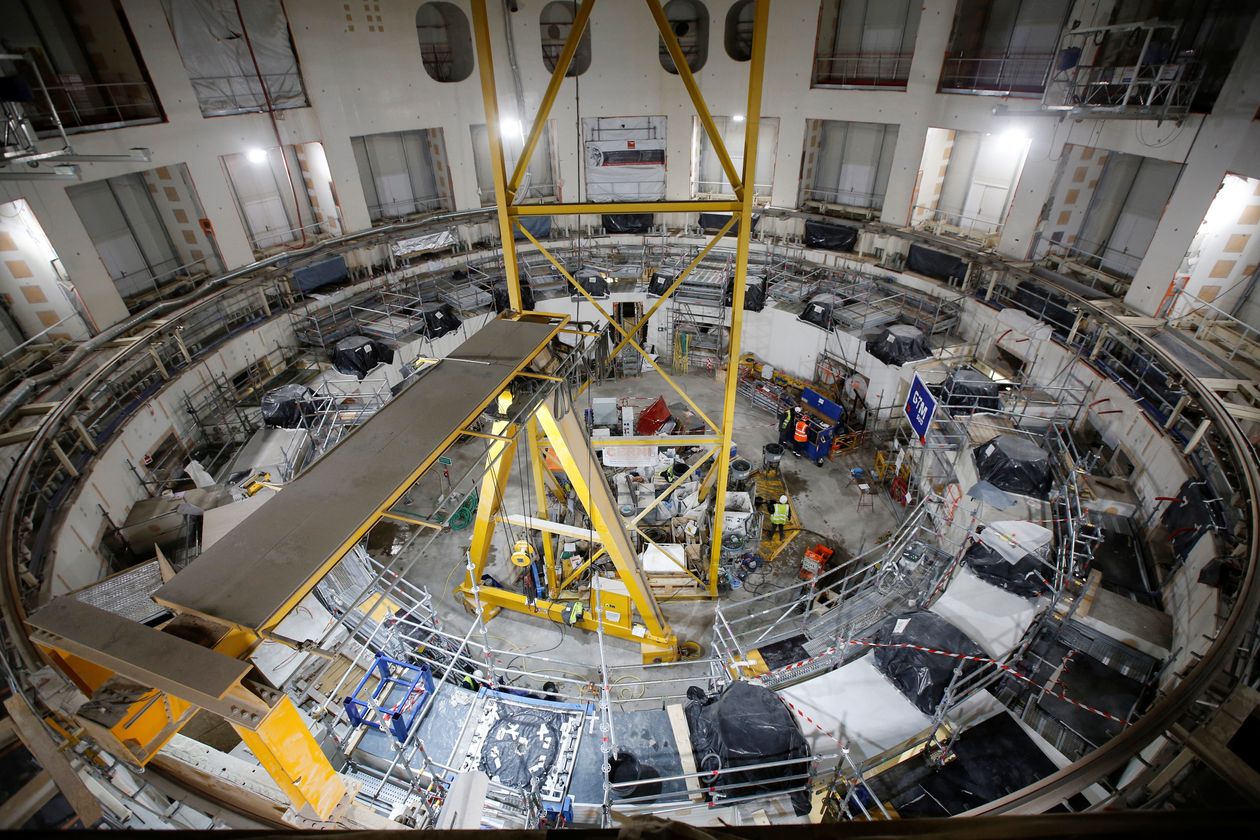

If any of the upstarts succeed, it will mark a scientific leapfrog for the record books. Until recently, the unquestioned leader on the path to achieving a self-sustaining fusion reaction—a crucial hurdle before developing power plants—was a 35-country consortium based in southern France called ITER. First proposed at a summit in 1985 between then-President Reagan and Soviet leader Mikhail Gorbachev, the project today is a sprawling construction site of more than a dozen buildings. Coming together at its core is the world’s biggest fusion system, a 98-foot-tall drum housing a 37-foot-high doughnut-shaped reactor core.

The 35-country consortium known as ITER is building the world’s biggest fusion system, with a 98-foot-tall drum and 37-foot-high donut-shaped reactor core, in southern France. Source: JEAN-PAUL PELISSIER/REUTERS

One of ITER’s ‘poloidal field coils,’ a component critical to establishing the reactor’s magnetic field. Source: ITER

The project, costing more than $20 billion, was designed to show fusion’s viability and develop needed technologies—not put power on the grid.

“ITER is really the final step in fusion research to enable the design and production of commercial machines,” says Director-General Bernard Bigot in his office overlooking armies of hard-hatted workers.

Slated to begin testing in 2025 and achieve fusion around 2035, ITER targets a 10-fold increase in power between what goes in and what comes out. If all goes well, Mr. Bigot foresees others leveraging ITER’s research to build commercial fusion plants in the 2050s.

Private ventures aren’t alone in trying to move faster. A new Chinese government project aims for fusion power before 2050, according to the Chinese Academy of Sciences.

Success for a newcomer wouldn’t mean ITER is for naught. Officials across the growing industry say recent advances would have been impossible without work being done by government projects like ITER and Princeton’s lab.

“We’re going to learn a lot from ITER,” says Bob Mumgaard, chief executive of Commonwealth Fusion Systems, a Boston-based startup spun out of the Massachusetts Institute of Technology, another fusion hub.

Mr. Mumgaard, who previously worked at MIT on early ITER research, exemplifies the crossover between labs and startups. As with the commercialization of space, fusion entrepreneurs have leveraged government research and hired government experts.

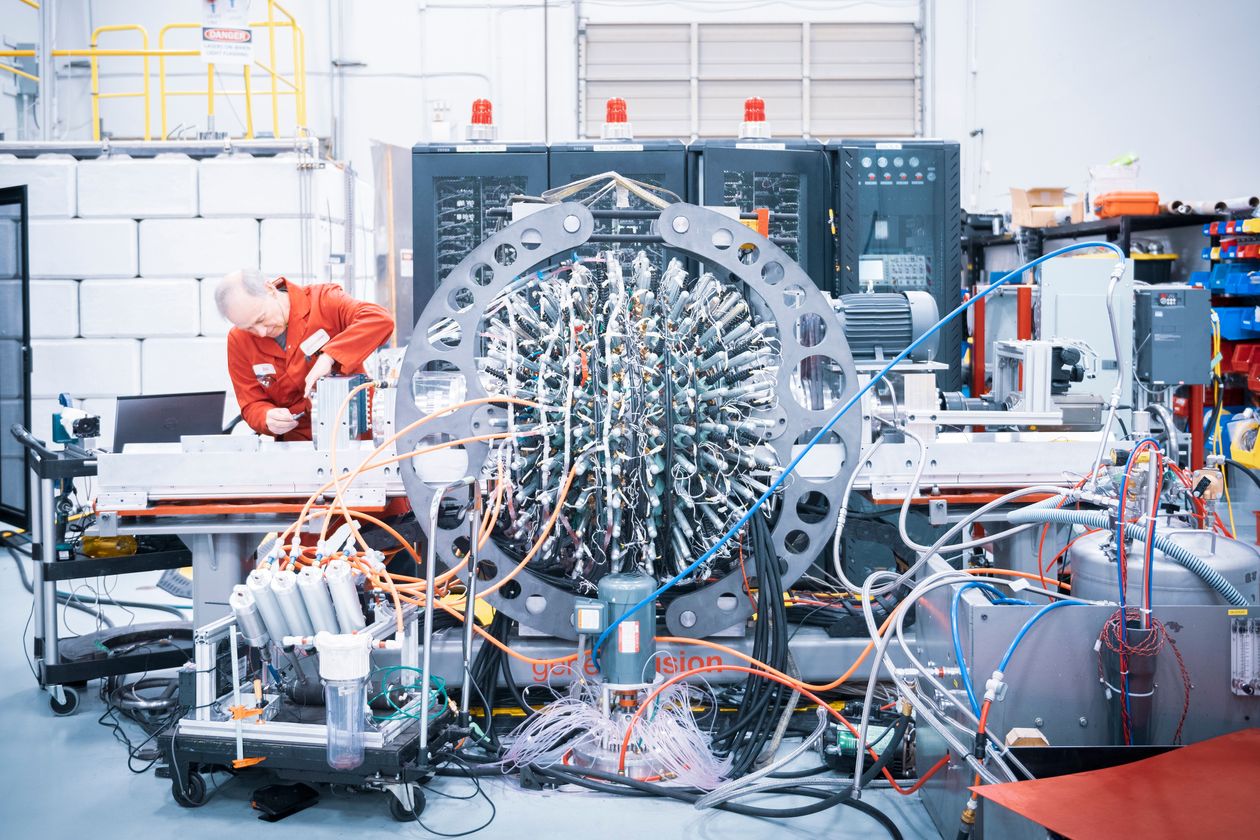

A 70% scale model of General Fusion’s plasma injector, a prototype of the component that will be assembled into the demonstration version of the company’s fusion system. Source: KRISTOPHER GRUNERT FOR THE WALL STREET JOURNAL

“This is kind of the SpaceX moment for fusion,” says Christofer Mowry, chief executive of General Fusion, a venture based in Vancouver, Canada, referring to how Elon Musk started Space Exploration Technologies Corp., known as SpaceX, by commercializing work of the U.S. space program. “Our starting point is on the basis of mature science.”

General Fusion’s approach—mechanical compression inside a spherical reactor using synchronized pistons—was enabled in part by 3-D printing and digital industrial controls, Mr. Mowry says.

Both Commonwealth Fusion in Boston and Tokamak Energy in Oxford aim to shrink ITER’s doughnut-shaped reactor to a scale that could fit inside a gymnasium by using new electromagnets roughly 2% the size of ITER’s. The magnets use novel alloys that become superconductive at temperatures achievable with commercially available helium, so are much less expensive and energy-intensive to operate.

First Light avoids magnets and relies more on physical compression in a collapsing bubble, painstakingly planned on computers. Leaps in processing power have helped simulate blindingly fast shock waves, as have advances in the science of modeling and machine learning. “Just a bigger computer isn’t enough,” says Mr. Hawker.

The prospect of compact, affordable fusion reactors producing bountiful energy but no greenhouse gasses that researchers say contribute to climate change has sparked investor interest. The 21 startups in the Fusion Industry Association, a trade group to lobby for government support and legislation necessary for fusion power, together have raised as much as $1.5 billion—most of it in the past five years, says Executive Director Andrew Holland. At the association’s inception in 2017, only 14 companies were involved, he says.

A General Fusion scientist monitors a small-scale plasma injector. Source: KRISTOPHER GRUNERT FOR THE WALL STREET JOURNAL

General Fusion in December raised $65 million, its fifth funding round, from investors including Singapore’s sovereign-wealth fund, Temasek. Bill Gates and Jeff Bezos have bankrolled fusion startups through funds aimed at transforming energy. Few investors are traditional venture capitalists. Since payback could take more than a decade, investments today are “almost philanthropy,” says Mr. Cowley at Princeton. “Investors want to be part of something that will change the world.”

ITER’s Mr. Bigot fears some may be overly optimistic. “I don’t see any option being explored now able to deliver continuous power to the grid by 2030,” he says. He questions whether materials exist to protect the insides of compact fusion reactors, which could get even hotter than his giant machine.

“If they succeed, we applaud them,” says Tim Luce, head of science and operations at ITER.

One issue not sparking deep concern is radioactivity. Fusion reactions can’t snowball out of control if a reactor breaks, as existing fission nuclear reactors can; without the required heat and pressure to sustain it, fusion would just stop. Reactor components used in fusion would pose little danger before long, because only a small amount of mildly radioactive fuel is required and the residue has a relatively short half-life. Fission waste, which is far more radioactive, lasts for eons.

Another consensus across the fusion world is it’s no longer a scientific riddle. Today it presents engineering challenges of equipment, materials and designs that can be tackled with time, testing and money, say proponents.

“It’s not an issue of if but when,” says ITER’s Mr. Luce.

General Fusion built its compression system testbed in 2019. Source: KRISTOPHER GRUNERT FOR THE WALL STREET JOURNAL